General Ledger (Accounts)

In This Topic...

General Ledger (G/L) accounts are configured to track debit and credit transactions associated to various account types. These accounts can be integrated with external accounting systems.

Managing General Ledger Accounts

- Open the appropriate Billing Entity. For instructions on finding and opening a billing entity, see the section on Managing Billing Entities.

-

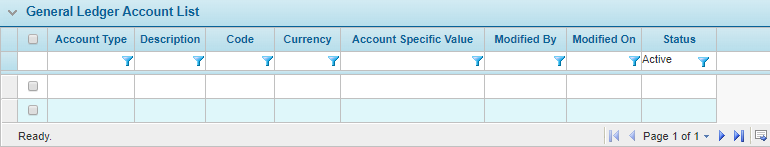

In the Billing Entity Menu, select General Ledger, then click Accounts. The General Ledger Account List page opens.

Tip: By default, only Active accounts are displayed. Clear the filter in the Status column to view all accounts.

- Select an action.

- Click a link in the Account Type column to view an existing account.

- Click Add to add a new account.

- Check the boxes for one or more accounts and click Deactivate to disable the selected fields. An account can also be deactivated from the General Ledger Account List window. Inactive accounts will still be functional in existing configurations, but cannot be selected for new configurations.

-

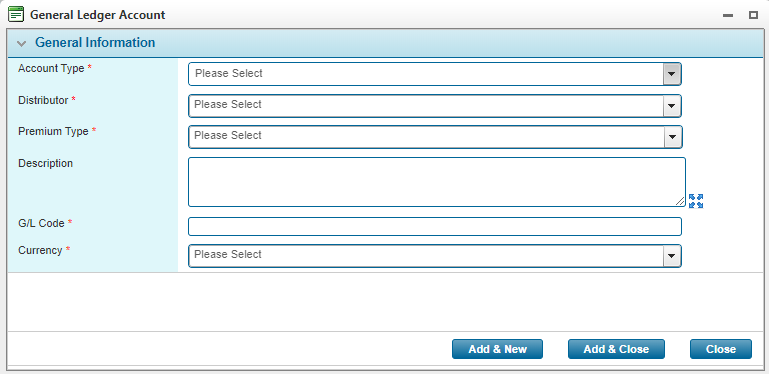

On viewing or creating an account, the General Ledger Account List window opens.

- The panels and fields are described below. Fields marked with a red asterisk * are required.

- Billing Adjustment

-

Bill to Party Suspense

- Clearing

- Clearing - Claims Payable

-

Deductible

- Deferred Premium Income

- Invoiced Commission Expense

- Invoiced Tax

- Written Premium

-

Click Add & New to save the details and clear the form to enter another account, click Add & Close to save and return to the accounts list, or click Close to return to the accounts list without saving the account.

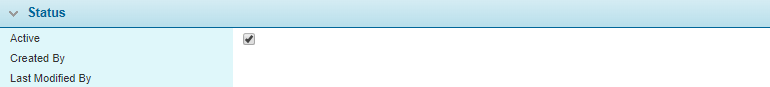

The Status panel is displayed once the account has been saved.

Marks the account as active and available for use. If unchecked, the account remains linked to any existing configurations, but cannot be used for new setups. An inactive account cannot be reactivated if there is already an active account with the same settings.

Identifies the date and time the account was created, and the user who created it.

Identifies the last date and time the account was changed, and the user who made the changes.

Tip: Individual accounts can also be deactivated or reactivated directly through the General Ledger Account List.

For each Account Type configured, a corresponding billing Report is created to track related debit and credit transactions. This occurs upon performing one of the following operations: binding a policy or generating an invoice (depending on the option configured in the Settings), processing a payment from insurers, distributors and bill to party payables, or posting a batch receipt.

|

Select the account type from the list, or select Miscellaneous to create a custom account. |

|

|

Creates an Accounts Payable account for a specific distributor. On selecting this option, the Distributor field is added to choose the distributor. |

|

|

Creates an Accounts Payable account for a specific insurer. On selecting this option, the Insurer field is added to choose the insurer. |

|

|

Creates an Accounts Receivable account for a specific insurer. On selecting this option, the Insurer field is added to choose the insurer. |

|

| Creates an Advanced Premium account. | |

|

Creates an Agency Bill Account Receivables account. The Agency Bill Accounts Receivable account tracks receivables for all premium related activities owed by Agency Bill Distributors. |

|

|

Creates a link to a configured bank account. On selecting this option, the Bank Account field is added to choose the associated account. The Currency field displays the currency type associated with that account. See the section on Managing Bank Accounts for details on preparing bank account configurations. |

|

|

|

Creates an Accounts Receivable account for Billing Adjustment values. On selecting this option, the Adjustment Type field is displayed to choose the adjustment type. |

|

|

Creates a Bill to Party Suspense account when an overpayment of cash is received and the Automatically Apply to Invoices of Type field is set to Other. |

|

|

Creates an entry for Cancellations to track returned premiums and taxes and to track unapplied amounts when posting a batch receipt. |

|

|

Creates a Clearing - Claims Payable account to track invoiced charges of type Deductible when the total invoice outstanding amount is a negative value. |

|

Creates a Commission Expense account for a specific product and premium type. Two additional fields are added on selecting this option. A Product and Premium Type can be selected. |

|

|

|

Creates a Deductible account when an overpayment of cash is received and the Automatically Apply to Invoices of Type field is set to Deductible. |

|

Creates a Deductible Recovery account. An additional field is added when this option is selected. Expense or Indemnity can be selected as a Payment Type. |

|

|

Creates a Deferred Commission Expense account for the sum of charge commission detail amounts associated to the invoice. |

|

| Creates a Deferred Commission Revenue account. | |

|

Creates a Deferred Insurance Direct Cost account for the sum of the Insurance Cost across all policies and insurers on the invoice. The Insurance Direct Cost is calculated as per calculating the Insurance Cost per Insurer. |

|

|

|

Creates a Deferred Premium Income account associated to the invoice for the sum of charge gross amounts. |

|

Creates an Insurance Direct account for a specific product and premium type. Two additional fields are added on selecting this option. A Product and Premium Type can be selected. |

|

|

|

Creates an Invoiced Commission Expense account when the invoiced Bill to Party is set to Distributor. The Invoiced Commission Expense account tracks all invoiced commission charges per distributor. |

|

Note: The Distributor lookup field is display in the General Ledger Account modal when creating this account type, in order to add the distributor associated to the invoice. |

|

|

|

Creates an Invoiced Tax account for invoiced charges of type Premium. This account tracks all entries for tax charges associated to the generated invoice, per Tax Type. |

|

Creates an account that can be named and configured as required. |

|

|

Creates an account for receivable insurer payments in compensation for claims paid to the assured. |

|

|

Creates a Premium Accounts Receivable account. The Premium Accounts Receivable report tracks all receivables owed by clients for all premium related activities with the exception of receivables owed to Distributor Bill to Parties. For additional information, see the Agency Bill Accounts Receivable section. |

|

| Creates a Premium Income account for a specific product and premium type. | |

| Two additional fields are added on selecting this option. A Product and Premium Type can be selected. | |

|

Creates an account for suspense values. |

|

|

Upon posting a batch receipt for a General Ledger - Suspense account, users are presented the following warning message: "Receipt allocation exists on a suspense account." This allows users who post cash receipts with an unknown Bill to Party, to correctly re-allocate the receipt once the appropriate Bill to Party is known. |

|

|

Creates an account for a specific tax. Additional fields are added on selecting this option. |

|

|

Creates an account for amounts that have been written off for all invoice types. |

|

|

|

Creates a Written Premium account per Premium Type specified. Users can configure each Written Premium account per Premium Type associated to the policy. |

| Distributor |

This field is only shown when configuring an Invoiced Commissions Expense account. Upon selecting this account type, select a Distributor from the lookup field associated to the invoice. |

| Premium Type |

This field is displayed when configuring Commission Expense, Insurance Direct Cost, Premium Income, and Written Premium accounts. The Premium Type dropdown field lists all Premium Types available in the system. Upon selecting a premium type, the G/L entries recorded are separated per Premium Type in the Written Premium account. |

|

Enter a description for the account. |

|

|

Only shown when configuring a standard General Ledger account. Enter a code for the account. This code will be used to identify this account when integrating with external accounting systems. This code does not need to be unique, allowing multiple internal accounts to be mapped to a single external account. |

|

|

Policy field codes can be used as the G/L Code value. When entered, the system will return the G/L Code as the field value on the policy. |

|

|

Note that if an invalid placeholder is entered, the code will remain as a string and will not return the appropriate value. Special characters (including underscores, periods, and non-alphabetical characters), are not supported. If a special character is included in the policy custom field, the system displays a warning message. Users can enter multiple field codes, individually enclosed in square brackets within the placeholder. Each code must include the appropriate opening and closing brackets ( [[ ]] ), or the system will display a warning message. |

|

|

Select the currency for the account. For Bank Accounts, this field will be defaulted to the currency defined for the selected account. |

Note: General Ledger Accounts must be unique. If another active account exists with the same Account Type and Currency, and any fields specific to the account type, the new account cannot be saved. The existing account must be modified or deactivated in order to save the new account.

General Ledger Report Entry Generation Events

Under defined system events, an entry recording each financial transaction is made in the corresponding billing Report.

This occurs when performing one of the following operations:

- Binding a policy (based on Settings configured).

- Generating an invoice (based on Settings configured).

- Processing a payment from insurers, distributors and bill to party payables.

- Posting a batch receipt.